You will need to tell HMRC that you have exceeded your Annual Allowance. You do this via a Self Assessment tax return.

If you do not currently complete a Self Assessment tax return, you can register for Self Assessment on the HMRC website - This link opens in a new browser window.

You will need to register for Self Assessment no later than 5 October 2025.

You can file your Self Assessment tax return online on the HMRC website - This link opens in a new browser window. You can still complete a paper form if preferred.

You will need to input the following information:

- how much of your total pension savings during 2024/25 exceeds your Annual Allowance (after Carry Forward); and

- if you are using Scheme Pays, the Annual Allowance tax charge the Trustee will pay on your behalf along with the Plan’s pension scheme tax reference number.

You will find the Plan’s pension scheme tax reference number on your pension savings statement.

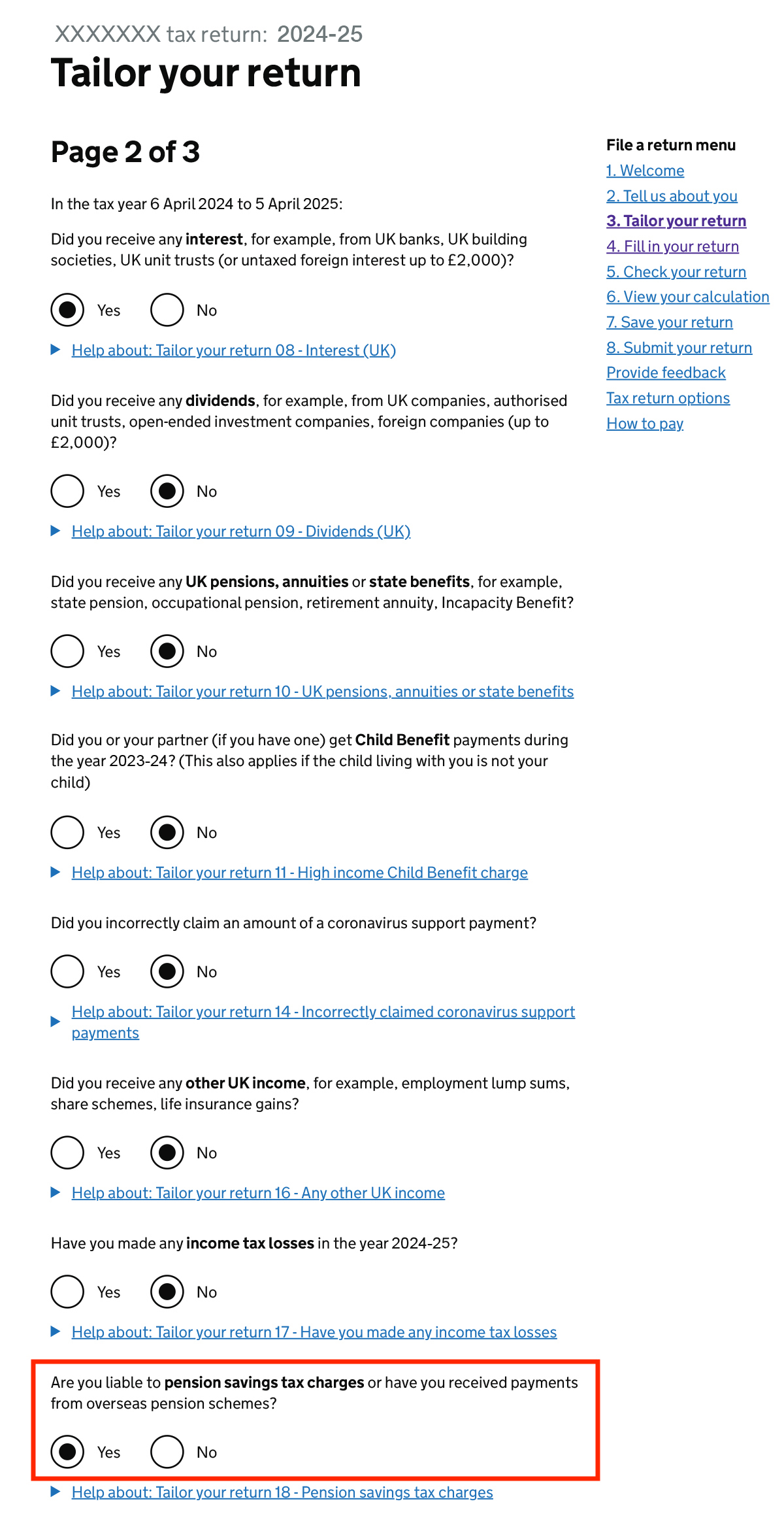

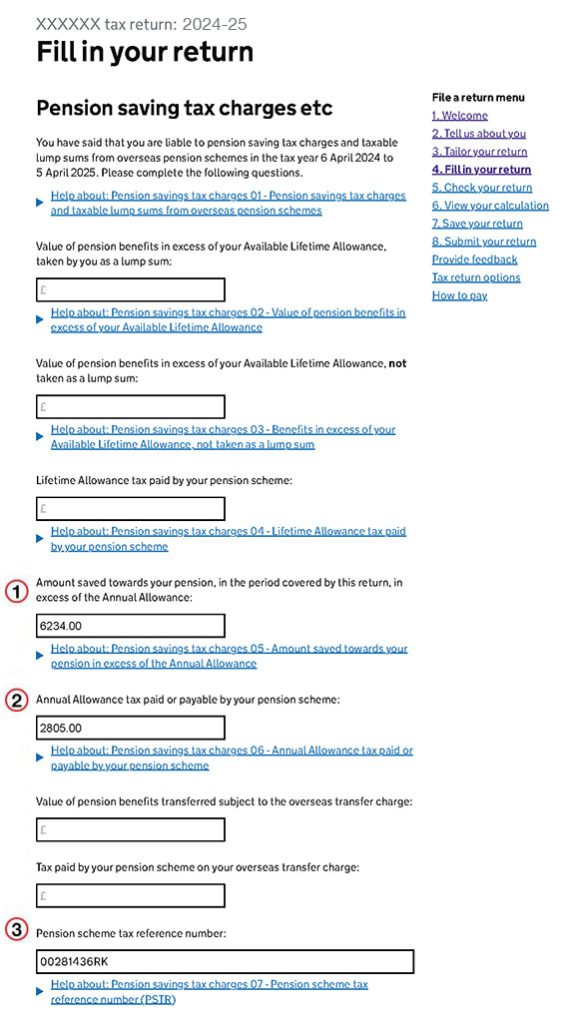

You can see an example Self Assessment return, completed in respect of someone who is using Scheme Pays below.

Example of the online Self Assessment return

- Alex had an excess above the Annual Allowance of £6,234, so he enters £6,234 in box 1.

- Alex intends to pay his Annual Allowance tax charge of £2,805 by Scheme Pays, so he enters £2,805 in box 2.

- Alex is using Scheme Pays, so he enters the Pension Scheme Tax Reference for the Plan (00281436RK) in box 3.