Your Annual Allowance is the maximum Pension Input Amount that can be paid each year to all your pension arrangements without incurring a tax charge. You can use the flow chart below to determine your Annual Allowance limit.

Have you have already flexibly accessed benefits from a defined contribution (DC) arrangement?

Yes

No

My Money Purchase Annual

Allowance is £10,000 NB: if you are subject to the Money Purchase Annual Allowance (MPAA) you will have been issued with a certificate by the provider of the pension arrangement

Is my Threshold Income under £200,000?

Yes

No

My Annual Allowance is £60,000

Is my Adjusted Income under £260,000?

Yes

No

My Annual Allowance is £60,000

Your Annual Allowance is reduced by £1 for every £2 your Adjusted Income is over £260,000

Please note that the minimum Annual Allowance is £10,000

- What is a Money Purchase Annual Allowance?

If you have already flexibly accessed benefits from a defined contribution or a money purchase arrangement and have been issued with a certificate confirming that you are now affected by the Money Purchase Annual Allowance (MPAA), please go to the Submit a document form and upload a copy of the certificate. Please note MPAA is a limit to the amount you can add to a defined contribution or money purchase arrangement. In certain limited circumstances, the MPAA can also affect the amount that you can save in a defined benefit arrangement. If you believe that you may be affected by this, please contact the pensions team. The MPAA for the 2024/25 tax year is £10,000.

As this is a complicated area, you may wish to call 0800 0931462 for free guidance from WEALTH at work, who can also provide you with personal tax advice, at your expense. Alternatively, you can access further information on how to find a retirement adviser on the MoneyHelper website. You will have to pay for the advice or services you receive from the adviser.

- What is Threshold Income?

Threshold Income is broadly your total taxable income, including, for example, any of the following:

- money you earn from employment (including bonuses). On your P60 this is marked as the figure which should be used for your tax return.

- benefits you get from your job (i.e. private health insurance)

- profits you make if you are self-employed

- most pension income (state, occupational and personal pensions)

- interest on most savings

- income from shares (dividend income)

- rental income

- income from a Trust

If your Threshold Income for the tax year is £200,000 or less, then your Annual Allowance is £60,000.

- What is Adjusted Income?

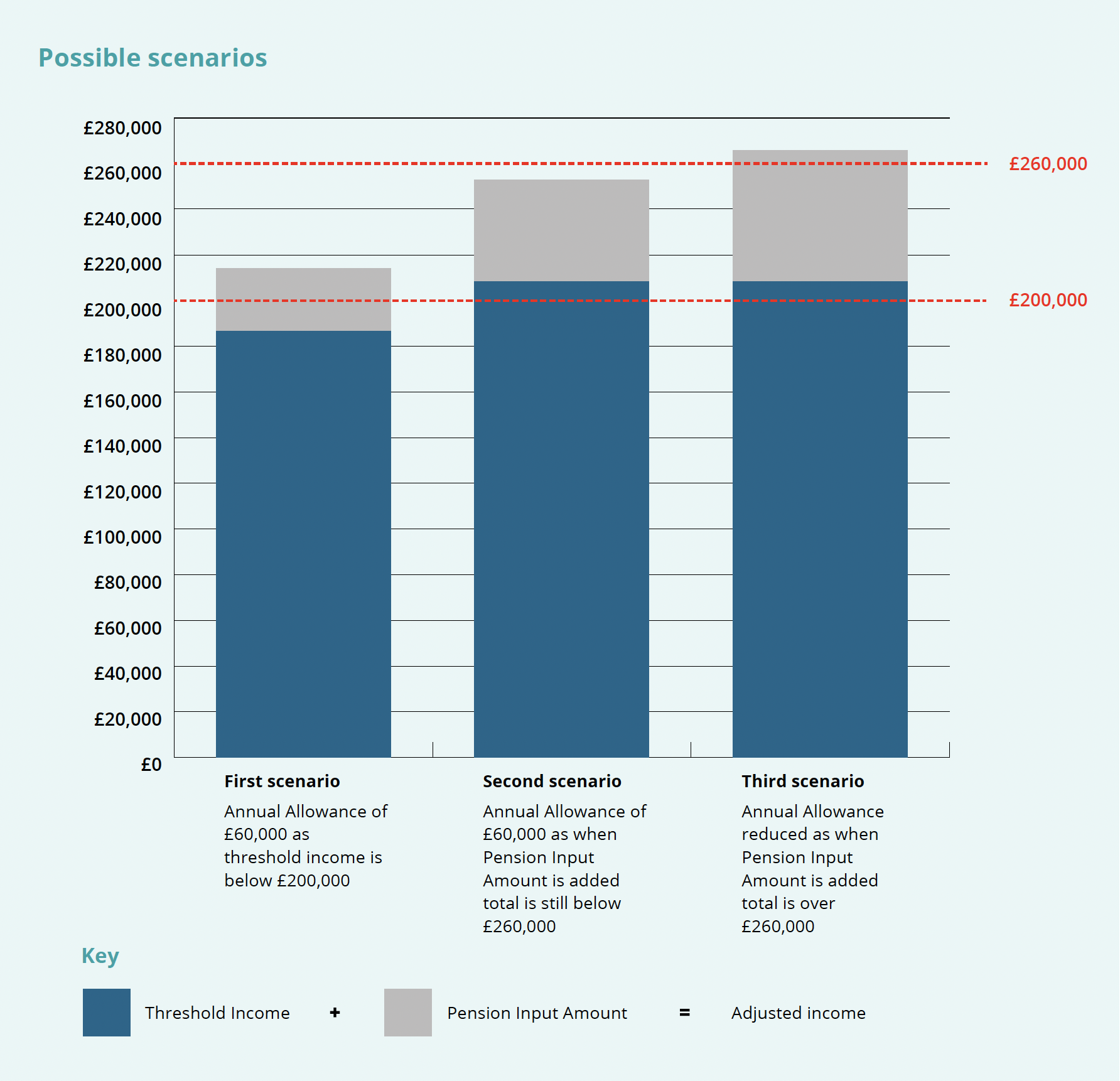

If your Threshold Income is over £200,000, then the level of your Adjusted Income will determine what your Annual Allowance is. Your Adjusted Income is broadly your Threshold Income, plus the total value of your Pension Input Amount (aggregated across all your pension arrangements).

- How will my Annual Allowance reduce?

Your Annual Allowance is reduced by £1 for every £2 your Adjusted Income goes over £260,000, down to a minimum Annual Allowance of £10,000.

Some possible scenarios are set out below.

- Exceeding your Annual Allowance

If your Pension Input Amount from all pension arrangements exceeds your Annual Allowance then you may be subject to an Annual Allowance tax charge. However, you can Carry Forward any unused Annual Allowance from the three previous tax years to offset pension savings above the Annual Allowance in the relevant tax year.

You must use up the Annual Allowance in the current Pension Input Period first, then go back to the earliest of the three carry forward years available. You must have been a member of a pension arrangement in an earlier year to be able to Carry Forward unused Annual Allowance (although you do not have to have contributed to that pension arrangement). Please ensure that you keep a copy of all your pension savings statements to provide Carry Forward figures in future years.

If in a previous tax year, you have exceeded the Annual Allowance and therefore have used some or all of your available Carry Forward, you will need to take this into account in determining unused Carry Forward. If you need help in determining your Carry Forward, please contact the WEALTH at work telephone helpline 0800 0931462 or your financial adviser.

You will need to review your pension savings statement alongside any statement(s) you may have received from any other providers you have pensions arrangements with. We can only provide you with your Pension Input Amount in the Plan, we cannot calculate whether you exceed the Annual Allowance after allowing for any unused Carry Forward, or the level of tax to apply.

Details of the following limits from previous years may help you to calculate any Carry Forward available:

Tax year Minimum Annual

AllowanceThreshold

IncomeAdjusted

Income2021/22 £4,000 £200,000 £240,000 2022/23 £4,000 £200,000 £240,000 2023/24 £10,000 £200,000 £240,000 2024/25 £10,000 £200,000 £260,000 The standard Annual Allowance for 2024/25 is £60,000.

- Examples – for illustrative purposes only

For illustrative purposes only

For 2021/22, her Pension Input Amount of £34,750 did not exceed her Annual Allowance of £40,000 and she was not liable for an Annual Allowance tax charge. She also Carried Forward £5,250.

For 2022/23, her Pension Input Amount of £38,850 did not exceed her Annual Allowance of £40,000 and she was not liable for an Annual Allowance tax charge. She also carried forward £1,150.

For 2023/24, her Pension Input Amount of £45,370 did not exceed her Annual Allowance of £60,000 and she was not liable for an Annual Allowance tax charge. She also carried forward £14,630.

For 2024/25, she was promoted and so her Pension Input Amount increased to £62,325 which exceeded her Annual Allowance of £60,000*. She used £2,325 of her available Carry Forward from 2021/22 which meant that she did not have an Annual Allowance tax charge. She has £15,780 available to carry forward to use in 2025/26 if needed.

Pension Input

PeriodAnnual

AllowancePension Input

AmountCarry

forward2024/25 £60,000 £62,325 £0 2023/24 £60,000 £45,370 £14,630 2022/23 £40,000 £38,850 £1,150 2021/22 £40,000 £34,750 £5,250 Table showing example Annual allowance, Pension input amount and Carry forward – Chris * How did Chris calculate her Annual Allowance for 2024/25?

Chris has the following earnings in the tax year 2024/25:

Gross earnings from employment (minus Chris’s pension contributions): £185,200 (From P60) Company Car: £9,000 (From P11D) Private medical (benefit in kind): £900 (From P11D) Total taxable income: £195,100 Chris has the following earnings in the tax year 2024/25: Chris does not exceed the Threshold Income limit of £200,000, so her Annual Allowance is £60,000.

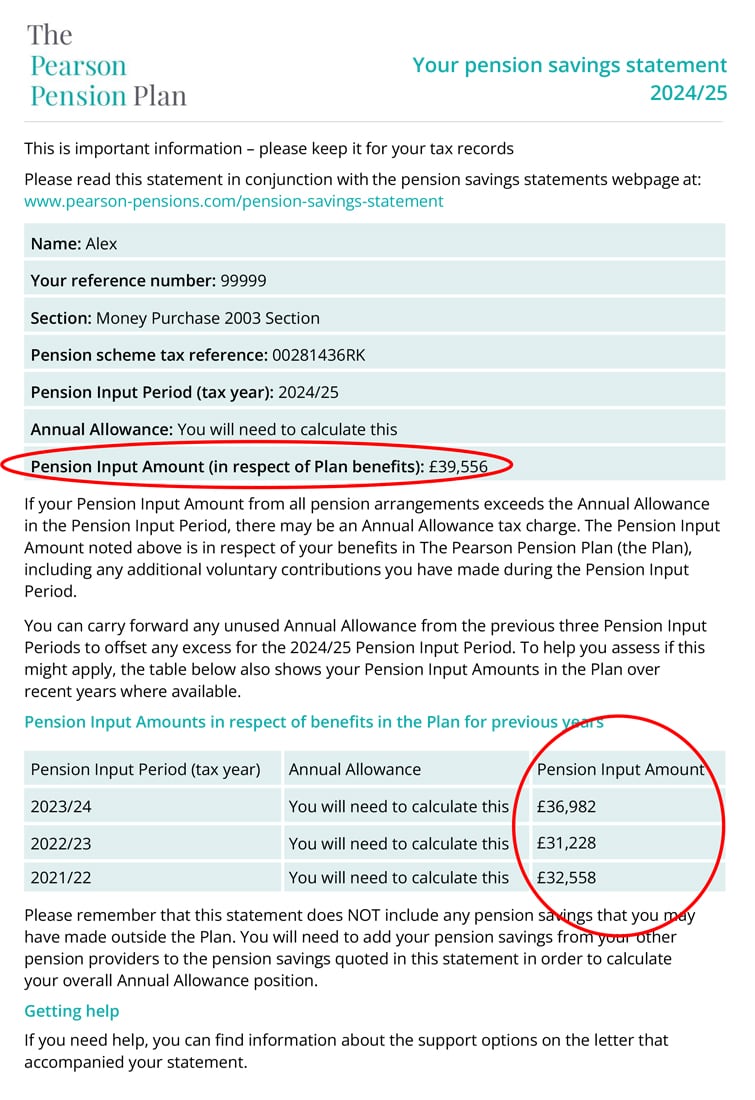

For illustrative purposes only

For 2021/22, his Pension Input Amount was £32,558 and he paid an Annual Allowance tax charge of £5,405. He had no Carry Forward available for this year.

For 2022/23, his Pension Input Amount was £31,228 and he paid an Annual Allowance tax charge of £10,683 He had no Carry Forward available for this year.

For 2023/24, his Pension Input Amount of £36,982 and he paid an Annual Allowance tax charge of £979. He had no Carry Forward available for this year.

For 2024/25, his Pension Input Amount of £39,556 exceeded his Annual Allowance of £33,322* by £6,234. As he did not have any available Carry Forward and his tax rate was 45%, his Annual Allowance tax charge amounts to £6,234 x 45% = £2,805.

Pension Input

PeriodAnnual

AllowancePension Input

AmountCarry

forward2024/25 £33,322 £39,556 £0 2023/24 £34,806 £36,982 £0 2022/23 £7,486 £31,228 £0 2021/22 £20,546 £32,558 £0 Table showing example Annual allowance, Pension input amount and Carry forward – Alex * How did Alex calculate his Annual Allowance for 2024/25?

Alex has the following earnings in the tax year 2024/25:

Gross earnings from employment (minus Alex’s pension contributions): £246,950 (From P60) Private medical (benefit in kind): £900 (From P11D) Rental income: £25,950 Total taxable income: £273,800 Alex has the following earnings in the tax year 2024/25: Alex exceeds the Threshold Income limit of £200,000, so he needs to know his Adjusted Income which is calculated as:

Total taxable income: £273,800 PIA: £39,556 (This is provided in his pension savings statement) Adjusted Income: £313,356 Alex’s Adjusted Income calculations for 2024/25: Alex’s Adjusted Income is £53,356 above the £260,000 limit so his Annual Allowance reduces to £33,322 (£53,356 ÷ 2 = £26,678, £60,000 – £26,678 = £33,322).

For illustrative purposes only

Sam accessed a DC pension pot that he held with another provider and took the whole amount as a taxable lump sum. This meant that he triggered the Money Purchase Annual Allowance of £10,000. If he pays contributions to the Plan in excess of £10,000, he is liable for the Annual Allowance tax charge at his marginal rate of tax.

In 2024/25, Sam and Pearson paid a total of £16,000 in contributions to the Money Purchase 2003 (MP03) Section. His Annual Allowance tax charge is £16,000 – £10,000 = £6,000 x 40% = £2,400.

As he has triggered the Money Purchase Annual Allowance, he is not able to use any Carry Forward to offset against the Annual Allowance tax charge.

HMRC Annual Allowance calculator

HMRC have created a pension savings Annual Allowance calculator to help you work out your Annual Allowance and whether you have a tax charge.

The calculator will work out:

- your available Annual Allowance (including any Carry Forward amount)

- your available Money Purchase Annual Allowance (MPAA) (if applicable to you)

- the amount of your pension savings on which tax is due (if applicable)

- your unused 2024/25 Annual Allowance (if applicable).

To be able to use the HMRC calculator you will need to know the following information:

- your Pension Input Amount for all pension arrangements for the tax years you want to check (you will need to get details about any benefits you have built up within any other pension schemes from the administrators of those schemes) Please note that you may need to put in more than three years of history to get an accurate calculation of your Carry Forward

- if and when you have flexibly accessed your defined contribution (DC) pension savings

- if your Threshold Income is more than £110,000 for tax years 2019/20 and 2019/20, and more than £200,000 between 2020/21 and 2024/25

- your Adjusted Income for each year that your Threshold Income is more than £110,000 for tax years 2019/20, and more than £200,000 between 2020/21 and 2022/23, and more than £260,000 for 2023/24 and 2024/25

The HMRC calculator works for members of UK registered pension schemes and qualifying overseas pension schemes. The HMRC calculator cannot be used by members of hybrid schemes (which offer a mixture of defined benefit (DB) and DC pension rights).

- How much has been saved in your pension schemes for the dates you want to check

You can find your Pearson Pension Plan Pension Input Amount for the last complete tax year, and each of the three previous years, in your pension savings statement.

You will need to get details about any benefits you have built up with any other pension schemes from the administrators of those schemes.

If you have already flexibly accessed benefits from a defined contribution (DC) or a money purchase arrangement and have been issued with a certificate confirming that you are now affected by the Money Purchase Annual Allowance (MPAA), please go to the Submit a document form and upload a copy of the certificate. Please note MPAA is a limit to the amount you can add to a defined contribution or money purchase arrangement. In certain limited circumstances, the MPAA can also affect the amount that you can save in a defined benefit (DB) arrangement. If you believe that you may be affected by this, please contact the pensions team. The MPAA for the 2024/25 tax year is £10,000.